Are you considering a Cost of Living in Ireland to Ireland in 2025? Whether you are a working professional, student, or just an interested tourist, knowing how much it costs to live in Ireland is essential to organizing your trip. Known for its breathtaking landscapes, rich cultural heritage, and world-class educational institutions, Ireland promises an enriching experience. However, making the most of your time in the Emerald Isle requires careful budgeting.

This comprehensive guide will help you navigate the financial aspects of living in Ireland. From exploring the cost of living in Ireland for Indian students to understanding the average cost of living across cities, we’ll provide you with the insights you need to plan wisely. By the end of this guide, you’ll be equipped to make informed decisions that align with your goals and ensure a smooth transition to your new life in Ireland.

What is the Cost of Accommodation in Ireland and the Overall Cost of Living in Ireland?

Accommodation is often the largest expense when living in Ireland, making it vital to choose the right option based on your needs and budget. Understanding the cost of living in Ireland is essential for making informed decisions. Here’s an in-depth look at the different types of housing available, along with their approximate costs:

1. On-Campus Housing

This is a preferred option for cost of living in Ireland students, particularly those new to Ireland. On-campus housing is convenient as it eliminates the need for commuting and often includes utilities like electricity, heating, and internet.

- Cost Range: €600 to €1,200 per month.

- Advantages: Proximity to academic facilities, opportunities for networking with peers, and access to student-specific amenities.

- Limitations: Limited availability; you’ll need to apply early to secure a spot.

2. Shared Apartments

Sharing an apartment with roommates is a cost-effective option, especially popular among Indian students and young professionals. This setup allows you to split expenses such as rent, utilities, and groceries.

- Cost Range: €500 to €800 per month per person.

- Advantages: Lower monthly costs, opportunities to build social connections, and flexibility in choosing locations close to schools or workplaces.

- Limitations: Shared living spaces may compromise privacy and come with differing household habits.

3. Private Rentals

For those seeking privacy and independence, private rentals are the ideal choice. However, this option is significantly more expensive, especially in major cities like Dublin.

- Monthly price range: €1,200 to €2,000, based on the city and kind of home.

- Advantages: Complete privacy, control over living conditions, and customization of the space to suit personal preferences.

- Limitations: Higher costs, especially for centrally located or fully furnished apartments.

How Much Do Groceries Cost in Ireland?

Groceries form a significant part of monthly expenses, and understanding the average cost of food items in Ireland can help you budget effectively. As part of the overall cost of living in Ireland, knowing grocery prices is essential. Whether you’re a student cooking your meals or a family managing household expenses, being aware of these costs and shopping smartly can save you a considerable amount of money.

Need more tips on managing your budget in Ireland? Check out for expert advice and services to help you save!

Average Weekly Grocery Costs

In Ireland, the typical weekly grocery bill ranges between €50 and €100, depending on your lifestyle, dietary preferences, and family size. Students and single professionals often fall on the lower end of this spectrum, while families may require a higher budget.

Breakdown of Common Grocery Items

Here are some average prices for everyday essentials:

- Milk (1L): €1.10

- Bread (500g): €1.50

- Eggs (12): €3.00

- Rice (1kg): €2.00

- Chicken (1kg): €8.00

- Apples (1kg): €2.50

- Potatoes (1kg): €1.50

Factors Influencing Grocery Costs

- Choice of Supermarket:

- Budget-friendly stores like Lidl and Aldi offer competitive prices, especially for staples like milk, bread, and

- vegetables.Premium supermarkets such as Tesco or Dunnes Stores provide a wider variety of products but at slightly higher prices.

- Location: Grocery costs can vary depending on where you shop. Urban centers like Dublin may have slightly higher prices compared to rural towns.

- Eating Habits: Opting for fresh produce and cooking at home is generally more economical than relying on pre-packaged meals or dining out frequently.

By shopping strategically and choosing the right stores, you can effectively manage your grocery budget while still enjoying a balanced and nutritious diet. Understanding these costs not only helps you plan financially but also makes your transition to life in Ireland smoother and more comfortable.

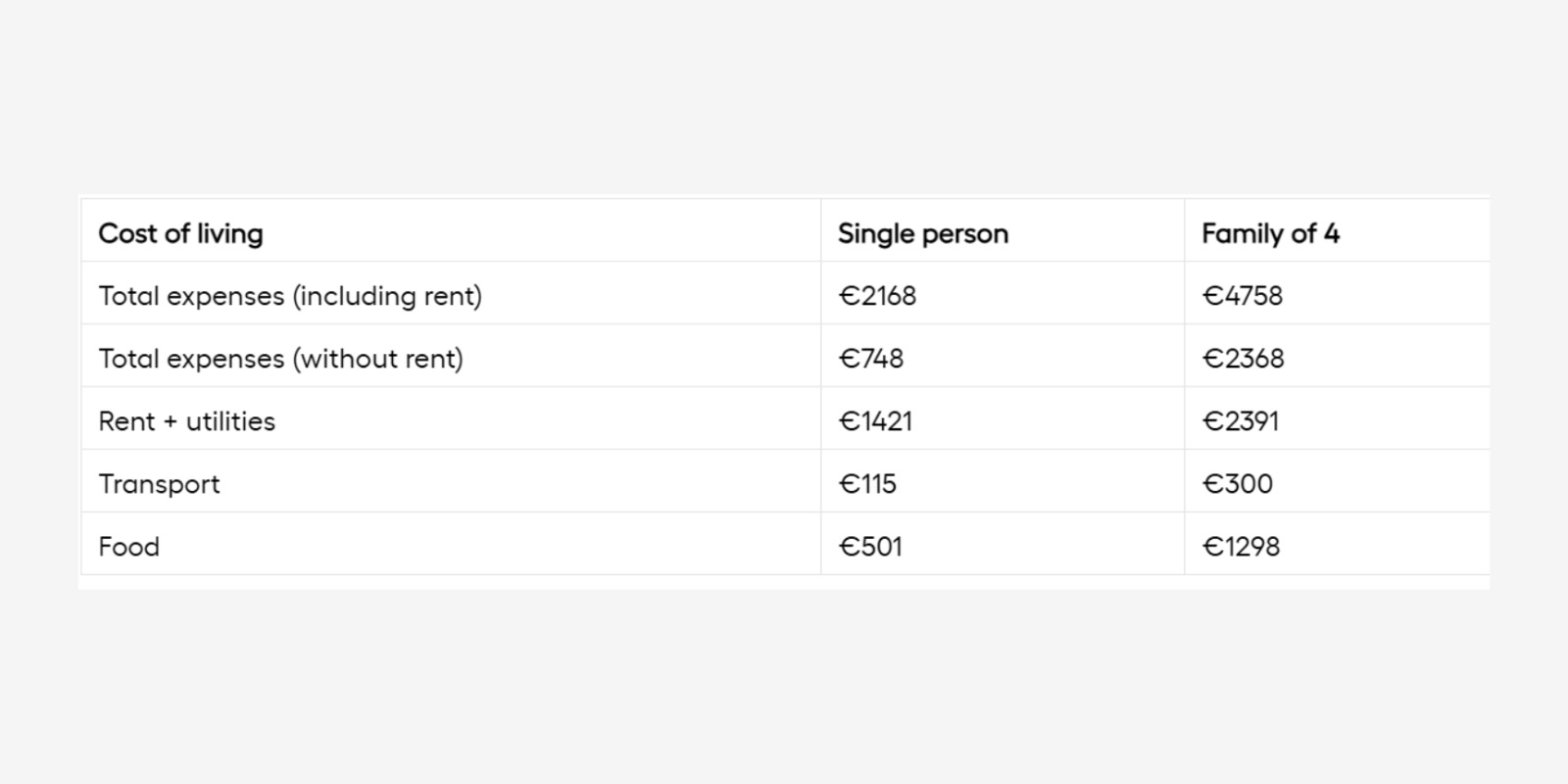

Comprehensive Guide to Living Expenses in Ireland

Ireland offers a dynamic lifestyle, but understanding the cost of living in Ireland is essential for students, expats, and residents alike. Below is a detailed breakdown of expenses to help you budget effectively and make the most of your time in this vibrant country.

1. Transportation Expenses in Ireland

Getting around in Ireland can be affordable, depending on your mode of transport.

Public Transport

Cities like Dublin, Cork, and Galway offer reliable public transport systems, including buses, trams, and trains.

- Monthly Pass: Costs approximately €120 in cities like Dublin, covering unlimited travel on buses, trams (Luas), and suburban trains.

- Student Discounts: Students can avail of discounted fares using a Leap Card.

Cycling

Cycling is an eco-friendly and budget-friendly option.

- Bike Rentals: Affordable at €20 per month, with city bike schemes like DublinBikes offering short-term and long-term rental options.

Car Owners

Owning a car offers convenience but comes with higher expenses.

- Fuel Costs: Around €1.70 per liter.

- Additional Costs: Include car insurance, parking fees, and annual road tax, which can add significantly to your budget.

2. Utilities and Internet Costs

Utility bills can vary based on your accommodation type and lifestyle.

Average Monthly Utility Bills

- Electricity, Heating, and Water: €150–€200 per month. Costs can spike during colder months due to heating.

- Internet: High-speed internet typically costs between €40 and €60 per month.

Tip: Opting for shared housing can significantly reduce utility expenses, as costs are split among tenants.

3. Healthcare and Insurance in Ireland

Ireland’s healthcare system combines public and private offerings.

Student Health Insurance

Mandatory for international students.

- Annual Cost: €150–€300, depending on the plan and coverage.

General Healthcare

- Doctor Visits: Cost around €60 per consultation.

- Private Health Insurance: Recommended for expats, with plans starting at approximately €1,000 annually.

4. Cost of Education for Indian Students

Education expenses and cost of living in Ireland vary based on the institution and program.

Tuition Fees

- Annual range: €9,000 to €25,000, based on university and course.

- Popular Fields: STEM courses and business programs often have higher fees.

Living Expenses

- Estimated Cost: €7,000–€12,000 per year, covering accommodation, food, and transportation.

5. Dining Out and Entertainment Costs

Ireland’s vibrant culture offers a range of dining and entertainment options.

Average Costs

- Meal at an Inexpensive Restaurant: Around €15.

- Movie Tickets: €12–€15 per person.

- Monthly Gym Membership: Ranges from €40 to €60, depending on the facilities.

6. Miscellaneous Expenses

These costs often vary based on personal preferences.

Common Monthly Costs

- Clothing: €50–€150, depending on shopping habits and seasonal needs.

- Mobile Plans: €20–€30, offering unlimited calls and data in most cases.

- Personal Care: €30–€50, covering toiletries and grooming essentials.

7. Budgeting Tips for Students and Residents

Smart budgeting can make your stay in Ireland more affordable. By understanding the cost of living in Ireland, you can plan your expenses wisely and enjoy your time without breaking the bank.

- Use Discounts: Leverage student discounts for public transport, movie tickets, and attractions.

- Shared Living: Sharing accommodation and utilities reduces expenses significantly.

- Shop Smart: Purchase groceries from budget supermarkets like Lidl and Aldi, and explore local markets for fresh produce.

- Cook at Home: Preparing meals at home is far more economical than dining out frequently.

- Plan Ahead: Track your expenses to identify areas where you can cut back.

By understanding and planning for these expenses, you can ensure a financially manageable and enjoyable stay in Ireland, whether you’re a student or a professional.

Conclusion: Genius Study Abroad – Your Trusted Ireland Study Abroad Consultant

Planning your budget and understanding the cost of living in Ireland are key steps in making your study abroad experience fulfilling and stress-free. From accommodation and transportation to daily expenses, having a clear plan helps you focus on your education and immerse yourself in Ireland’s vibrant culture.

At Genius Study Abroad, we’re proud to be your trusted Ireland Study Abroad Consultant for Ireland. With personalized guidance, expert support for university selection, visa processes, and financial planning, we’re here to make your journey as smooth as possible. Let us help you turn your dream of studying in Ireland into a reality!

📞 Ready to start your adventure? Contact us today 70 335 335 70

FAQs on the Cost of Living in Ireland

Q1: What is the typical cost of living for Indian students in Ireland?

The average cost of living in Ireland for Indian students typically ranges between €7,000 and €12,000 annually. This amount covers essential expenses such as accommodation, food, transportation, utilities, and other personal needs. The real cost will change based on your lifestyle and the city you decide to live in. Dublin, for example, is more expensive than smaller towns like Cork or Limerick. To manage your budget effectively, it’s crucial to account for both fixed costs (like rent) and variable costs (like groceries and entertainment).

Q2: Is Dublin more expensive than other Irish cities?

Yes, Dublin is generally the most expensive city in Ireland, particularly when it comes to accommodation. The demand for housing in Dublin is high, leading to increased rental prices compared to cities like Cork, Galway, or Limerick. Other living expenses, such as dining out, transportation, and entertainment, contribute to the cost of living in Ireland, which is higher in Dublin. However, Dublin offers more job opportunities, a vibrant social scene, and better access to public services, which may make the higher costs worthwhile for some. If you’re on a tight budget, smaller cities or towns can offer a more affordable lifestyle while still providing excellent amenities.

Q3: Can Indian students work part-time to cover expenses?

Yes, Indian students in Ireland are permitted to work part-time while studying. During the academic term, you can work up to 20 hours per week, and during official holidays or breaks, this increases to 40 hours per week. This can significantly help cover living expenses, especially if you’re studying in a city like Dublin where costs are higher. Many students take up jobs in retail, hospitality, or tutoring, which not only provide income but also valuable work experience. It’s important to ensure that your work does not interfere with your studies and that you comply with all visa and employment regulations.

Q4: How can I save on healthcare costs in Ireland?

Healthcare in Ireland can be expensive, especially for those who rely on private medical services. There are methods to control and lower these expenses, though

- Invest in Student Health Insurance: Many students opt for health insurance plans that cater specifically to their needs, with coverage for doctor visits, prescriptions, and emergency care. The annual cost for student health insurance ranges between €150 and €300.

- Utilize Public Healthcare: Ireland offers public healthcare services, which are subsidized for residents and students. If you are eligible, you can access medical services at lower costs, including doctor visits, hospital care, and prescription medicines.

Use Discounted Services: Some clinics and healthcare providers offer student discounts, so it’s worth checking for deals. Additionally, always check if your insurance plan covers specific treatments to avoid unnecessary out-of-pocket expenses.